© Reuters. EUR/USD -0.14% Add to/Remove from Watchlist Add to Watchlist Add Position

© Reuters. EUR/USD -0.14% Add to/Remove from Watchlist Add to Watchlist Add Position Position added successfully to:

+ Add another position Close GBP/USD -0.41% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close USD/JPY +0.25% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close USD/CNY +0.07% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close

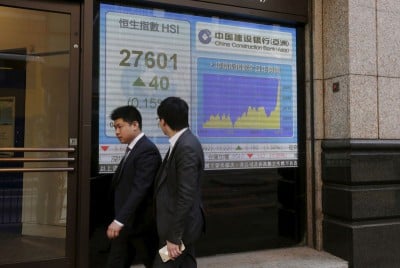

Investing.com - The U.S. dollar edged higher in early trade Wednesday, boosted by sticky inflation ahead of the latest Fed meeting, while sterling is hit by weak growth numbers.

At 05:25 ET (10:25 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% higher at 103.609.

Fed meeting to conclude

The U.S. currency gained after data overnight showed consumer prices unexpectedly rising in November, gaining 0.1% on the month, while dropping annually to 3.1% from 3.2%.

However, recent signs have pointed to a soft landing, as the Federal Reserve meets for the final time this year, concluding later Wednesday.

The U.S. central bank is widely expected to keep rates on hold, and investors will be mainly watching to see if Fed Chair Jerome Powell pushes back against the prospect of interest rate cuts in the first half of 2024.

“The Fed last raised rates in July and we think that marked the peak,” said analysts at ING, in a note. “However, the Fed will not want to endorse the market pricing of significant rate cuts until they are confident price pressures are quashed.”

Sterling slips after weak U.K. growth data

In Europe, GBP/USD fell 0.3% to 1.2523 after data showed that Britain's economy shrank in October, with gross domestic product falling 0.3% from September, the first month-on-month drop since July.

The Office for National Statistics stated that exceptionally wet weather might have impacted the data, but this release raises the prospect of a recession and lifts the pressure on the Bank of England to cut interest rates next year even with inflation still above target.

EUR/USD fell 0.1% to 1.0784 after eurozone industrial production fell 0.7% on the month, an annual fall of 6.6%.

This added to recent economic data which has pointed to the eurozone heading into a recession in the final quarter of the year, raising expectations that the European Central Bank could deliver its first rate cut early next year.

The ECB, BOE, Norges Bank and the Swiss National Bank all hold policy-setting meetings on Thursday, and are all expected to hold interest rates unchanged.

Yen retreats ahead of BOJ meeting

In Asia, USD/JPY traded 0.3% higher to 145.84, with the Japanese yen handing back some of its recent gains ahead of next week’s Bank of Japan meeting.

The central bank is widely expected to signal no changes to negative interest rates.

USD/CNY traded 0.1% higher at 7.1818, extending losses after a dismal reading on inflation over the weekend. China slid further into disinflation territory in November, indicating that economic conditions in the country remained weak.

Dollar gains ahead of Fed decision; sterling hit by weak GDP data